Becoming resident in Spain: Tax Obligations for Residents

Javier Nieto - Apr 9, 2021 - Property Advice

Javier Nieto - Apr 9, 2021 - Property Advice

Technically speaking, it is considered that a person is tax resident when stays more than 183 days a year in a country, when the main center or base of his/her interests or economic activities resides in Spain, or when his/her partner and minor children who depend on the first reside in Spain permanently, although the latter assumption admits evidence to the contrary.

If you are considered tax resident, you would be affected by the following taxes and obligations:

This tax is payable on the income obtained by an individual, regardless they are generated in Spain or abroad –i.e. you will pay tax on the income received worldwide-.

In Spain, the tax year matches the natural year, i.e., from 1st of January to 31st of December.

That income can arise from different sources. On one hand, salary, pension, income from rentals, earnings from professional activities, etc.. On the other hand, savings, interest, dividends, capital gains from the sale of a property, shares or investment in funds, etc.

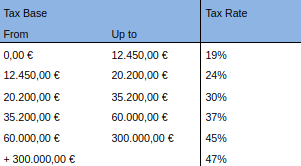

Tax rate. Depending on the source of income, there are two scales:

Personal and family circumstances will be taken into account when calculating your personal income tax. For example, there are tax deductions for elderly people, disabled people, for those who have children, etc.

The tax return for the tax year must be filed between May and June of the following year.

This tax is calculated on the basis of all the assets owned by a person in Spain and out of Spain by 31th of December of that tax year. The tax base would be the adding of assets and rights less the obligations and encumbrances.

You would be exempt of paying this tax up to the first 700,000€ of wealth, and in addition, your permanent residency located in Spain is also exempt up to 300,000€.

You have the obligation of submitting the Wealth Tax if the net wealth (assets minus obligations) is over 700,000 Euros per individual, or alternatively, a gross wealth of more than 2 million Euros.

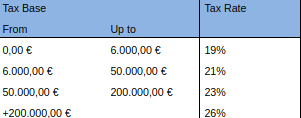

The Spanish central government recently changed the tax rate scale, back in December 2020. As it is up to the local government of the different jurisdictions called Comunidades Autónomas to modify or not said scale, although the below may vary depending on the decision to be made by our Andalusian government, we have laid out the scale that would be applicable at this moment as a reference:

Form 720 is an informative declaration where you provide details on your assets and rights located out of Spain. There is no tax associated to Form 720.

Any private individuals or companies that reside in Spain are obliged to file this form, when they have assets or rights abroad. The period for filing the form is between the 1st of January and the 31st of March of the following year.

This form is only filed once. However, whenever your assets belonging to each group increase on over EUR 20,000.00 with respect to the last form 720 filed, or sell or cancel, you must inform to the tax authorities by filing a new complement to that form 720

There are three groups of assets, and you must declare them whenever the value of the assets on each group is equal or over 50,000.00 €, regardless their individual value.

Every private individual is obliged to inform on the change of residency for the effects of taxation within a period of 3 months since they moved to the new address.

This must be done by filing a Form 030 at the Spanish tax office, or by filing the first personal income tax return.

In case during that period of change you have been taxed in another country, depending on whether there is a double taxation treaty in place, the tax paid abroad could be deductible when filing your personal income tax return in Spain.

Manzanares has a separate fiscal and accounts department specialized in tax matters. Our advice is that you get in contact with us in order to obtain a quotation for handling your tax affairs in Spain, and we will establish the scheme under which we will organize your tax.

In case you would like to have an informative meeting with our tax experts and obtain a simulation on how much tax you would pay, the cost of this service would be EUR 300.00. This amount will be deducted in case you decide to use our services for filing your tax.

For arranging this meeting with our Fiscal & Accounts Manager, Mr José Manuel Guillén, please contact his assistant on the following details:

Javier is the founder and CEO of Pure Living Properties. Born and raised in Marbella in an entrepreneurial family who settled on the Costa del Sol in the 1960s, when Marbella’s real estate and tourism industry was just a fledgling market, Javier is an expert connoisseur of Puente Romano, which he calls home, and the Golden Mile, but also of the best areas, projects and companies, as their owners and developers have been among his inner circle since childhood.